Banking websites as strategic assets: meeting customer and regulatory demands

In the past, customers would first step into a branch to explore a bank and its products. Today, their first interaction is almost always digital. Websites and apps are where customers form opinions, compare offers, and decide whether to trust a financial institution. For companies in the financial sector, this shift means that digital presence is not just a marketing channel – it is the very foundation of customer relationships.

This article explores why Polish and European banks cannot afford to underestimate the importance of website quality, and highlights four key areas where financial institutions must excel to deliver outstanding digital experiences.

Why Polish and European banking players must step up in providing top-quality web experience

As the digital channel has become the core of customer experience, it is no longer just about having a website that plays the role of a digital static brochure. Especially in Europe, a competitive and highly regulated financial market, the websites of financial institutions should function as secure, dynamic, and customer-centric platforms. Any weakness in speed, security, or accessibility can immediately translate into lost trust and lost business.

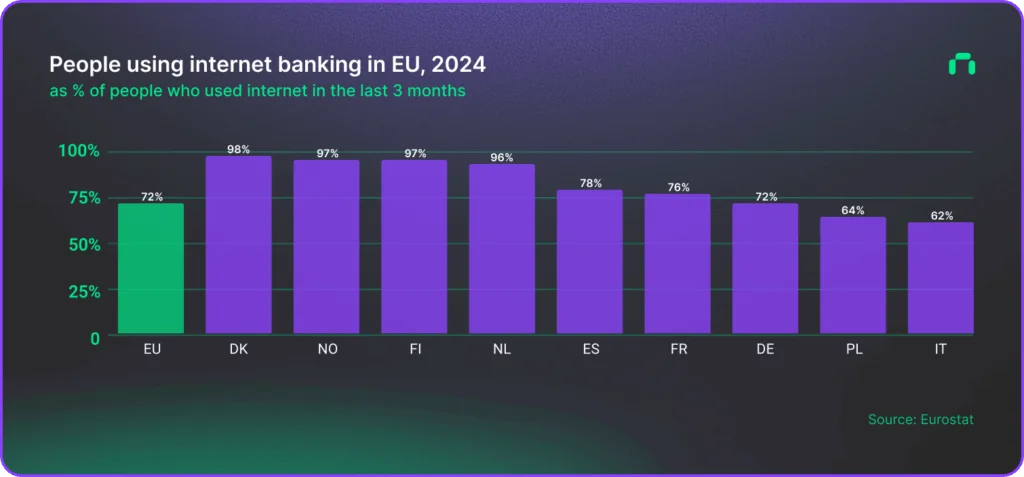

According to Eurostat 72% of internet users in the EU used online banking services in 2024 compared with 56% in 2014.

In Denmark, Norway, and Finland, over 90% of internet users reported using online banking in the past three months. In Poland, the figure stands at 64%, and it has been steadily increasing year by year.

Competitive pressure

It is no longer just about being present online. The data shows that customers have long been online themselves. Considering that they largely judge a bank by the quality of their digital experience, the real question is how well the financial institution meets those expectations.

If it does not, customers can easily switch to a competitor that offers a better website or online banking experience. Most competitors already provide online access to their products and services – so the challenge is no longer whether a bank is available online, but what kind of experience it delivers there.

Legal requirements

Gaining a competitive advantage is one thing, but the EU also poses legal regulations on the banking industry, so financial institutions are no longer free to design their websites purely from a marketing perspective. They must comply with a wide range of legal obligations. While PSD2 governs secure authentication and open banking APIs primarily within logged-in environments, other frameworks directly influence how banks design and operate their public-facing websites. From data protection to consumer rights and accessibility, EU regulations are increasingly shaping the customer journey long before a user decides to log in.

Except for the General Data Protection Regulation (GDPR), which affects everything from cookie banners to lead-generation forms, there are also the Consumer Rights and Unfair Commercial Practices Directives, which mandate transparent presentation of financial offers. And in terms of digital accessibility and inclusivity, the European Accessibility Act (EAA) from July 2025 requires banking websites to meet strict digital accessibility standards.

These legal frameworks require banking websites to evolve from simple marketing tools to compliance-critical assets, where failure to meet standards can result in legal penalties and reputational damage.

Four areas that define high-quality banking websites

A bank’s website is often the first point of contact between the customer and the brand – even before an account is opened. Considering both competitive pressure and regulatory requirements, a financial institution’s website must meet customer expectations and deliver the best possible experience across four key areas:

1. Security – protecting reputation and customer trust

Although banking security is commonly associated with what happens after logging in (such as transfers or account access), in practice the entire website infrastructure, including public product pages, can also serve as an attack vector.

Why public-facing pages are also critical from a security perspective

Cybercriminals often start with the “weakest link.” A bank’s public site is an attractive target, and if compromised, it can serve as a springboard into deeper systems.

If an attacker finds a vulnerability on a marketing website, they may use it for malware injection (e.g. injecting malicious code or JS scripts). For example in a contact form or a plugin, they can insert malicious code that captures customer data or redirects users to fake login pages (phishing). Attackers may also inject false information directly onto a bank’s website, misleading users and damaging credibility. This is why continuous content monitoring – for example, through integrity checks – is essential to ensure that what customers see is authentic and unaltered.

Poorly protected marketing websites can also be exploited as an entry point into the wider infrastructure and disrupt the whole service availability as a result of a Distributed Denial of Service (DDoS) attack, in which a server overloaded with artificial traffic stops responding to legitimate user requests, hence the website becomes unavailable.

As a result of an attack, even if no customer data is leaked, an infected product page (e.g., displaying fake offers or phishing links) immediately undermines the bank’s credibility.

Investment in strong security reassures customers their money and data are safe

Customers increasingly choose banks they perceive as the safest place for their money and personal data. A visible commitment to cybersecurity builds trust and loyalty. In highly competitive markets, where products and pricing often look similar, perceived digital safety can become the factor that tips customer decisions.

Adding the word “trustworthy” to a brandbook is not what builds trust among potential customers, though. It’s the measures a financial institution takes to make the customers feel safe while using the bank’s services – starting from transparent communication about protective measures all the way to fast reactions when threats arise. It takes years to build trust, and data breaches can destroy years of hard work and thousands of investments in a single day.

Security incidents in the financial sector rarely go unnoticed. When sensitive customer information leaks, the reaction is immediate: regulatory scrutiny and media headlines turn into a wave of customer distrust.

Even if the direct financial losses are limited, the reputational damage can last for years and directly affect customer retention. On the other hand, banks that are proactive – for example, by announcing major investments in cybersecurity, publishing regular transparency reports, or adopting advanced authentication methods – often gain positive media coverage and strengthen their image as trustworthy institutions. In this sense, cybersecurity is not just risk mitigation. It can also be positioned as a value proposition and a differentiator in a crowded marketplace.

Security in banking websites – major takeaways

- “Security by design” must cover not only transactional banking but also marketing and product pages.

- A bank cannot afford a situation where a customer visits a product marketing page only to have a malicious script steal their data.

- From a regulatory perspective, the GDPR and guidelines issued by the European Banking Authority (EBA) require an appropriate level of data protection regardless of whether it concerns the ‘transactional service’ or the ‘marketing service’.

2. Site performance & speed – every second counts in customer experience

Another factor that significantly shapes user perception is site performance and speed. Customers expect instant access, and slow websites lead to site abandonment.

According to a Google study cited by FasterCapital, increasing page load time from 1 to 5 seconds raises the likelihood of user drop-off by 90%. Moreover, 79% of customers dissatisfied with a site’s performance never return. Best practice suggests that page load time should not exceed 2 seconds. This is especially critical in the process of acquiring new customers. Frustrated by slow performance, they may abandon the exploration of banking products altogether and form a lasting negative impression of the brand.

Every part of the banking web service should be optimized for mobile devices, as in many EU markets over 70% of banking traffic comes from mobile. While most banks offer mobile apps for the transactional part of the service, the marketing part is usually only accessible through a web browser. This increases the role of marketing site performance in the banking sector – a fast website optimized for mobile performance not only signals professionalism and innovation of the bank’s brand, but above all increases the level of user experience and enhances user engagement.

Site performance may also directly impact product sales. Well-implemented interactive tools on marketing websites, such as credit or deposit interest calculators, can strongly influence a customer’s decision: encouraging them to proceed with a financial service or, if poorly executed, discouraging them from engaging with the institution altogether.

Consistent omnichannel performance

Polish banks are often praised for their mobile innovations (e.g., fast BLIK payments, well-designed mobile apps). However, their product and marketing websites are sometimes slower and less transparent than those of competitors in Northern or Western Europe.

It is crucial to ensure consistent omnichannel quality. A bank may have a well-designed and intuitive mobile app and an excellent customer service panel, but if the customer’s first impression comes from a poor experience on the public website, they may never reach the optimized transactional environment.

Digital performance is no longer a ‘nice to have’. It became a mandatory requirement for retaining customers and attracting new business.

Site performance & speed in banking websites – major takeaways

- Speed drives trust and conversion. Users expect pages to load within 2 seconds. Delays may dramatically increase abandonment and reduce customer retention.

- Mobile optimization is non-negotiable – with over 70% of banking traffic in the EU coming from mobile, marketing websites must perform on mobile devices as well as transactional mobile apps.

- Consistent quality of performance across channels matters – strong mobile apps & transactional panels cannot compensate for weak public websites. Digital performance must be seamless across the entire customer journey.

3. Accessibility – inclusion as law and opportunity

Accessibility for all users, including people with disabilities, is not only good practice and a demonstration of inclusivity. From July 2025, financial institutions serving customers in the European Union are required to comply with the European Accessibility Act (EAA). When it comes to websites, this means meeting specific standards defined by the Web Content Accessibility Guidelines (WCAG), which ensure that digital services are perceivable, operable, understandable, and robust for every user.

For more information on website optimization according to WCAG, check our article about:

WCAG in practice: how to design and develop accessible websites

Failure to comply with the EAA can lead to serious consequences. Penalties vary by country: for example, in Germany non-compliance may result in significant administrative fines, while in France regulators can order the withdrawal of inaccessible services from the market. Beyond financial penalties, institutions also face reputational risks, negative media coverage, and the potential loss of customer trust. In highly competitive banking markets, non-compliance can translate into long-term damage to brand perception.

In addition to the EAA, ensuring website accessibility aligns with the CSRD (Corporate Sustainability Reporting Directive), which from 2024/2025 obliges banks to provide detailed ESG (Environmental, Social, Governance) reporting. Maintaining an adequate level of accessibility on banking websites can also serve as evidence of commitment to the Social dimension of ESG. Digital accessibility is therefore not only about compliance with the EAA but also a demonstration that the bank actively addresses the Social pillar of ESG.

Beyond the legal requirements – accessible websites improve overall user engagement

Legal obligations are only one side of the story, though. According to the most recent Eurostat data, in 2024, 23.9% of people aged 16+ years in the European Union reported having a disability. This equates to approximately 87 million people across the EU having some form of disability as of 2025. That’s a wide group of potential customers whose needs should be properly addressed.

At the same time, a clear, easy-to-navigate website not only benefits people with disabilities but also improves the overall user experience for everyone. Considering the growing adaptation of internet banking across EU society, investing in accessible websites – intuitive and easy to use simply pays off. Because in practice, accessibility means less frustration among all users, higher engagement, and stronger customer loyalty.

Accessibility in banking websites – major takeaways

- From July 2025, banks in the EU must comply with the European Accessibility Act (EAA) and align with WCAG standards; accessibility also links to ESG reporting under CSRD.

- Penalties for non-compliance with the EAA differ across countries, but in each case they come with reputational damage and loss of customer trust.

- Accessible websites allow banks to expand their customer base and improve usability for all users, boosting engagement and loyalty.

4. Integration – making websites part of the banking journey

Websites presenting financial products can, and should, be much more than static brochures filled with dense, difficult-to-digest text. By leveraging the power of integrations, a traditional website can become an interactive tool that enhances user engagement, simplifies the description of offers, and ultimately increases conversion rates.

This can be achieved by:

Personalization – through integration with core banking systems, loan and product offers on bank websites can be dynamically tailored (e.g., based on credit scoring, login data, or even geolocation).

Interactive elements – e.g. advanced online calculators – that allow customers to adjust offer parameters through an intuitive interface can significantly improve conversion rates – provided they are fast, reliable, and consistently fed with accurate, up-to-date data. Poorly designed calculators, on the other hand, that are slow or unintuitive, may discourage potential customers. This is another strong reminder that implementation quality is critical.

Integrations support compliance with consumer law

Well-implemented integrations also help financial institutions comply with consumer protection regulations such as the Unfair Commercial Practices Directive (UCPD), the Consumer Rights Directive (CRD), and the Distance Marketing of Financial Services Directive (DMFSD).

They allow customers to see processed data presented in a clear and understandable way, helping them fully grasp the terms of an offer.

Instead of reading through 20 pages of promotional conditions, customers can use an interactive tool on the website that gives them a complete view of how much a service will cost over a given period, or how much they could earn on a particular investment.

Well-implemented integrations ensure that calculations displayed on the website are always correct, which reduces the risk of errors or misleading information.

Efficiency and consistency across channels

Well-integrated systems not only shorten customer journeys and improve conversion rates, they also reduce manual work for staff. Product data and changing offer parameters can be managed centrally and then automatically distributed in real time across multiple digital channels (websites, mobile apps) through integrations – eliminating the need to manually update each platform separately. Such an approach is not only efficient but also ensures greater accuracy and consistency in website updates.

Integrations in banking websites – major takeaways

- Integrations transform static product pages into interactive, personalized experiences that boost engagement and conversion.

- Dynamic calculators and tailored data presentations not only simplify complex offers but also support compliance with EU consumer protection regulations.

- Centralized integrations reduce manual work, ensure consistent updates, and deliver real-time accuracy across websites and mobile apps.

Summary

While the transactional part of a banking service is undeniably critical, the quality of marketing pages, accessible before the user logs into online banking, must not be overlooked. For many customers, these pages are the very first point of contact with a bank, and a poor initial experience can lead them to abandon the journey before they ever reach the transactional part of the service.

Security, speed, accessibility, and integration are the four pillars to build on not only for regulatory compliance, but also for customer trust, engagement, and loyalty.

Banks that invest early in raising the quality of their digital presence are rewarded with stronger customer relationships, improved brand reputation, and readiness for upcoming regulatory obligations.

Bank websites should no longer be treated as text-heavy brochures posted online. Instead, they should evolve into strategic assets that actively shape the customer journey, drive conversions, and secure long-term competitiveness in the European market.